Abstract

In the financial market, there are a large number of indicators used to describe the change of

stock price, which provides a good data basis for our stock price forecast. Different stocks are

affected by different factors due to their different industry types and regions. Therefore, it

is very important to find a multi factor combination suitable for a particular stock to predict

the price of the stock. This paper proposes to use Genetic Algorithm(GA) for feature selection

and develop an optimized Long Short-Term Memory(LSTM) neural network stock prediction model.

Firstly, we use the GA to obtain a factors importance ranking. Then, the optimal combination of

factors is obtained from this ranking with the method of trial and error. Finally, we use the

combination of optimal factors and LSTM model for stock prediction. Thorough empirical studies

based upon the China construction bank dataset and the CSI 300 stock dataset demonstrate that

the GA-LSTM model can outperform all baseline models for time series prediction.

Introduction

Buying and selling stocks is a very interesting thing. Because stocks can make investors get big

profits, but vice versa. To get a big profit, investors need to analyze in predicting stock

prices. However, predicting stock prices is a difficult thing to do because stock prices

fluctuate rapidly all the time. So that investors need to predict the stock price as short as

possible.

Genetic Algorithm or GA is a metaheuristic inspired by the process of natural

selection that belongs to the larger class of Evolutionary Algorithms (EA). Genetic algorithms

are commonly used to generate high-quality solutions to optimization and search problems by

relying on biologically inspired operators such as mutation, crossover, and selection.

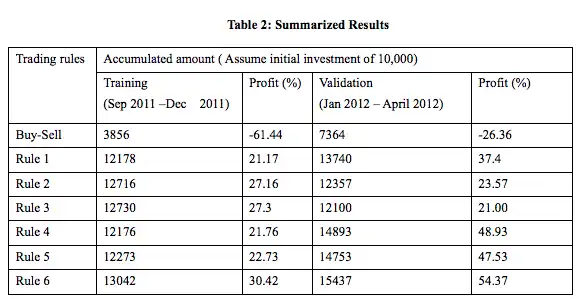

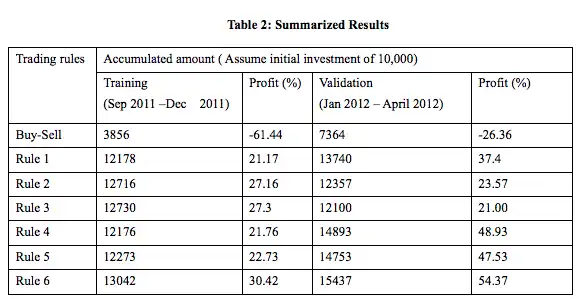

Related Work

GA is search algorithm based on the mechanics of natural selection and genetics and they combine

survival of the fittest among string structures to form a search algorithm (L. Davis, 1991). GA

is particularly suitable for multi-parameter optimization problems with an objective function

subject to numerous hard and soft constraints. The main idea of GA is to start with a population

of solutions to a problem, and attempt to produce new generations of solutions which are better

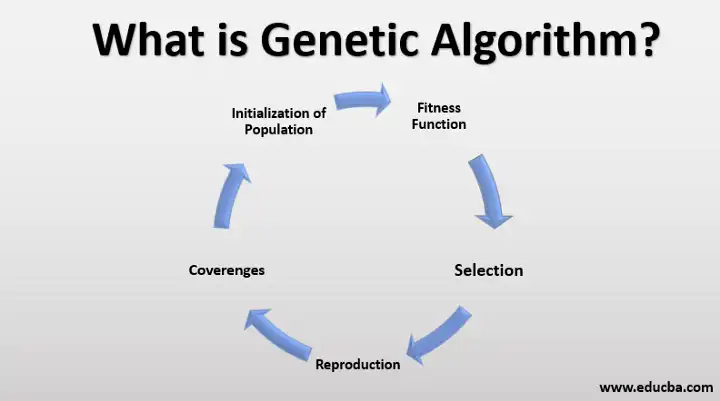

than the previous ones. GA operates through a simple cycle consisting of the following four

stages: initialization, selection, crossover, and mutation. Figure shows the basic steps of

proposed genetic algorithms model.

Trading Rule

Although there are an infinite number of possible rules by which we could trade, it seems that

only a few of them would have made a profit. To find the rule that would have yielded the most

profit had it been used to trade stocks on a given set of historical data, firstly, we develop

trading rules of this general form is as shown below.

General form of trading rules

- If today’s value of the indicator 1 is greater than or equal to (less than) A1,

- And change since the last day’s value of the indicator 2 is Greater than or equal to (less

than) A2,

-

And last day’s value of the indicator 3 is greater than or equal to (less than) A3

-

And last day’s value of the indicator 4 is greater than or equal to (less than) A4,

-

And last day’s value of the indicator 5 is greater than or equal to (less than) A5,

-

And today’s value of the indicator 6 is greater than or equal to (less than) A6,

There are five conditions that are evaluated for each trading day. If the all of five conditions

are satisfied, then the model will produce ‘buy’ signal on that day, otherwise it will suggest

‘sell.’ A1 to A6 denotes the cutoff values. The cutoff values range from 0 to 1, and represent

the percentage of the data source's range. For example, if RSI (relative strength index) ranges

from 0 to 100, then a cutoff value of 0.0 would match a RSI of 0, a cutoff value of 1.0 would

match a RSI of 100, and a cutoff value of 0.5 would match a RSI of 50. This allows the rules to

refer to any data source, regardless of the values it takes on. We consider additional

flexibility regarding the indicator component of the rule structure such as ‘today’s value,’

‘last day’s value,’ and ‘change since the last day’s value.’ Translating this in its full form,

for example, would yield the following statement:

Trading rules

-

If today’s value of ROC is greater than or equal to 30.0,

-

And change since the last day’s value of RSI is less than 60.0,

-

And last day’s value of stochastic %D is less than 51.0,

-

And last day’s value of A/D oscillator is less than 12.5,

-

And last day’s value of MACD is less than 14.9,

-

And today’s value of stochastic %K is less than 75.9,

Then buy else sell

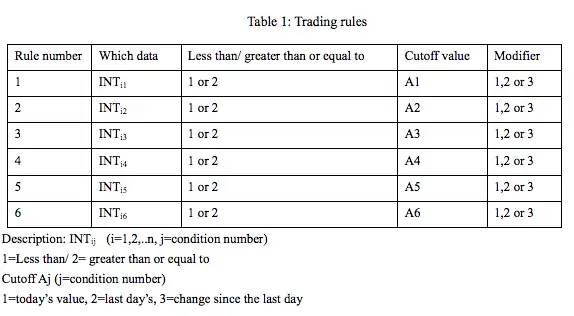

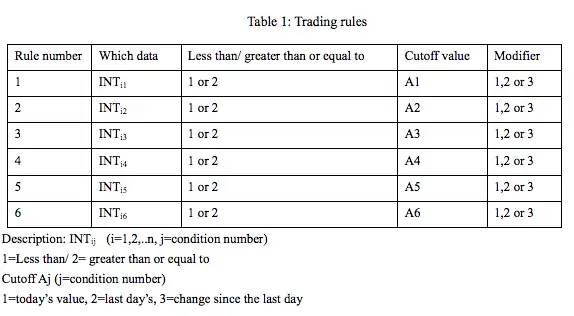

Above rule structure is summarized in Table 1. In Table 1, ‘which data’ means data source the

rule refers to, and ‘modifier’ means a modifier value that determines if the value itself should

be examined, or if the last day's value or the change since the last day should be examined.

There has been much debate regarding the development of trading system using historical data. We

agree that the future is never exactly like the past; however, a common investment approach is

to employ systems that would probably have worked well in the past and that seem to have a

reasonable chance of doing well in the future. So, we define a goal of the system as finding a

rule which would have yielded the highest return over a certain time period.